The reality of fragmented restaurant tech

The cause of this time-sink? Overly complex tech stacks.

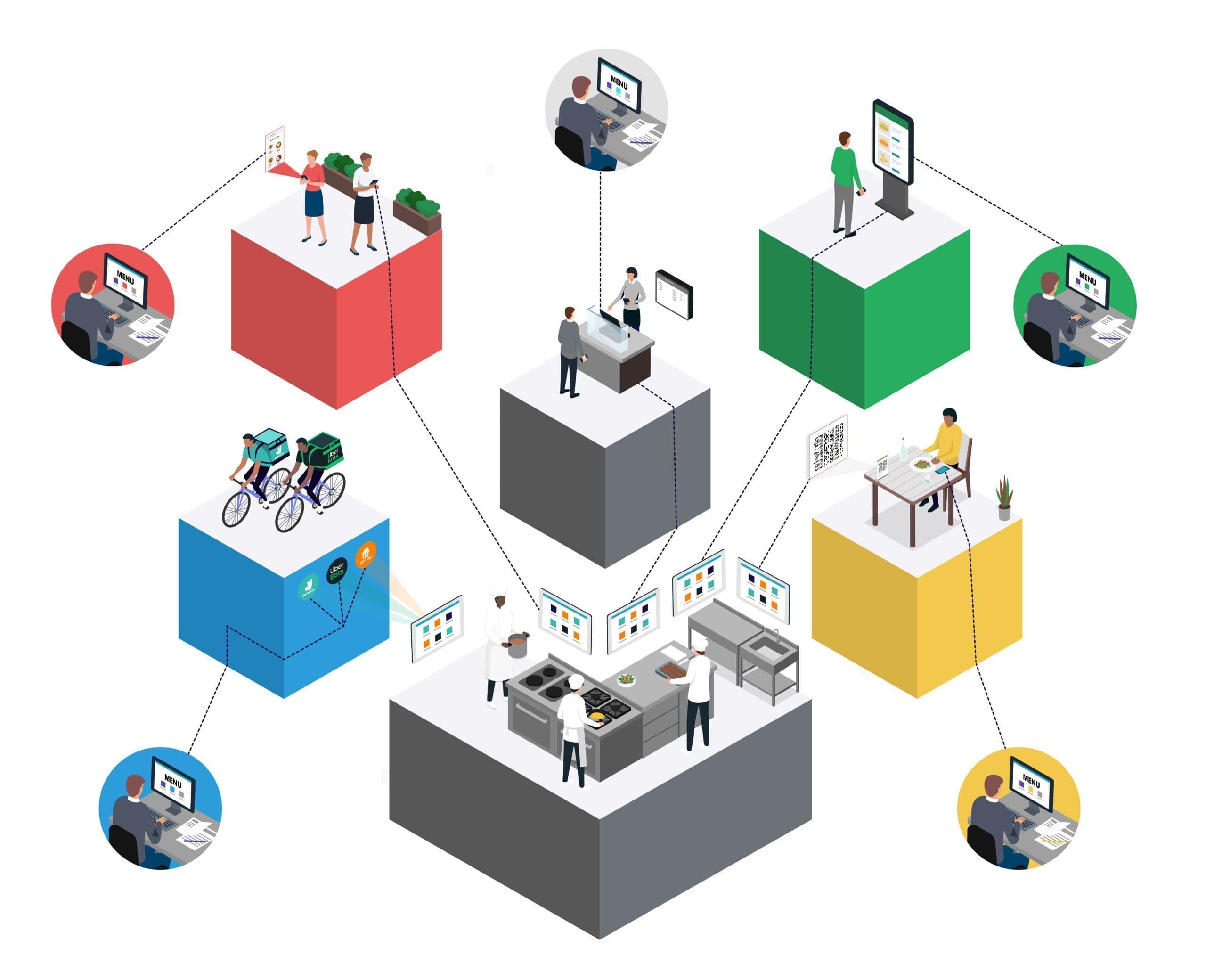

Tech innovation originally introduced new ways for restaurant brands to innovate and boost efficiency. But these were point solutions, focusing on just one part of the order management process and bolted onto an existing POS.

This has resulted in operators battling with a ‘Frankentech stack’ of integrations. This complex, fragmented web of point solutions has a profound effect on efficiency, operational stability and guest experience – and, as a result, growth.

That’s why simple jobs like updating menus or accessing data can become mammoth tasks.

How restaurant operators are unblocking growth by changing priorities

These point solutions have always been seen as the only way for restaurants to keep up with innovation. This has meant operators continue to rely on them to chase growth, despite the inefficiencies they create that actually make it impossible.

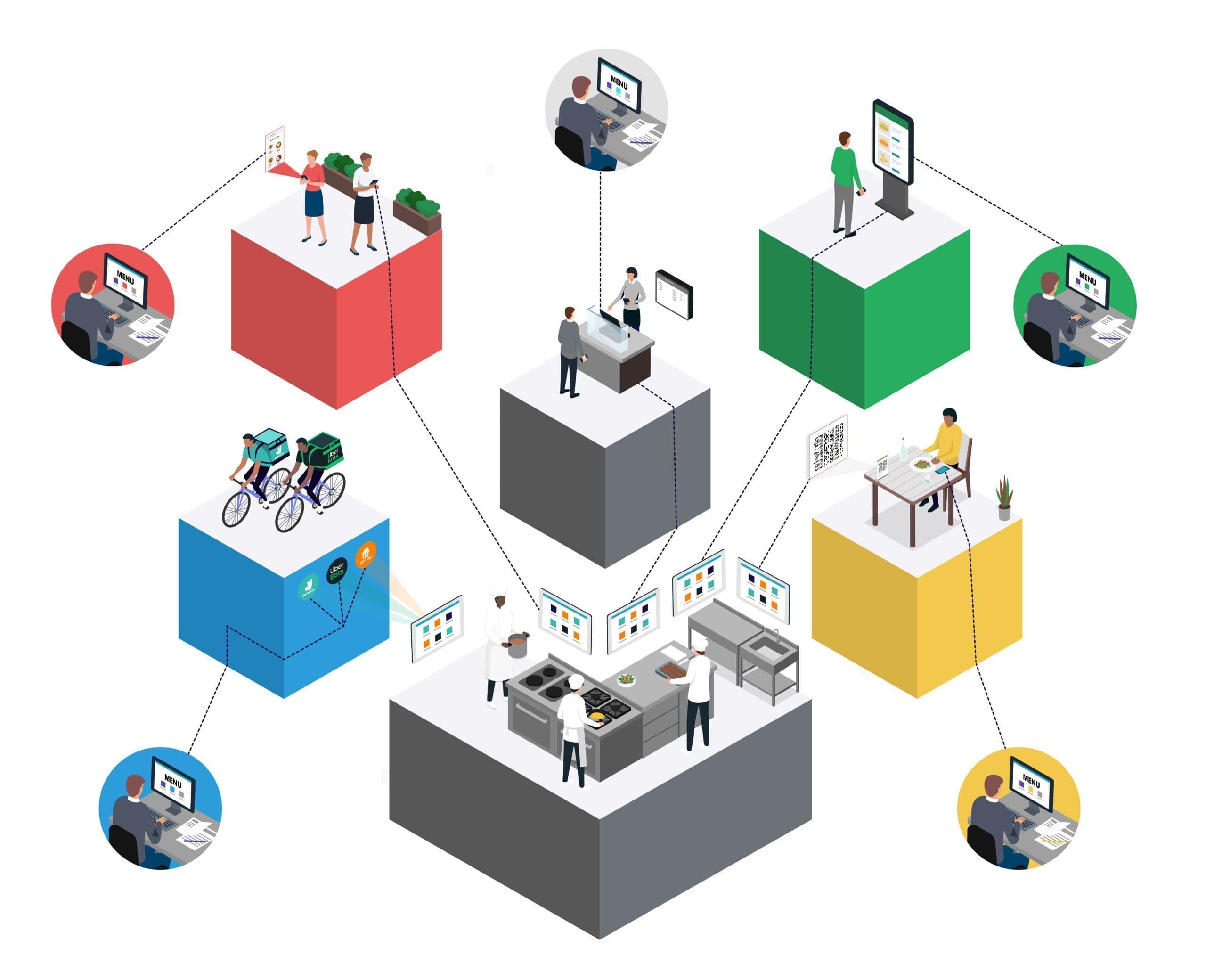

But with the advent of centralised restaurant tech, growth-minded operators now need to adopt a new way of thinking.

Almost 40% of operators recognise that having multiple providers is inefficient, and over 50% report that a lack of time is blocking them from achieving business goals.

And yet only 28% of operators reported that improving efficiency is a top focus area for the business.

This is where changing priorities becomes the key to unlocking growth.

A focus on improving efficiency

We’ve seen forward-thinking brands report exponential growth after rejecting their fragmented tech stack and moving operations to a single order management system.

By fixing these issues causing simple tasks to become mammoth jobs, operators can unblock processes and actually dedicate time to those all-important tasks that enable growth.